Six capitals

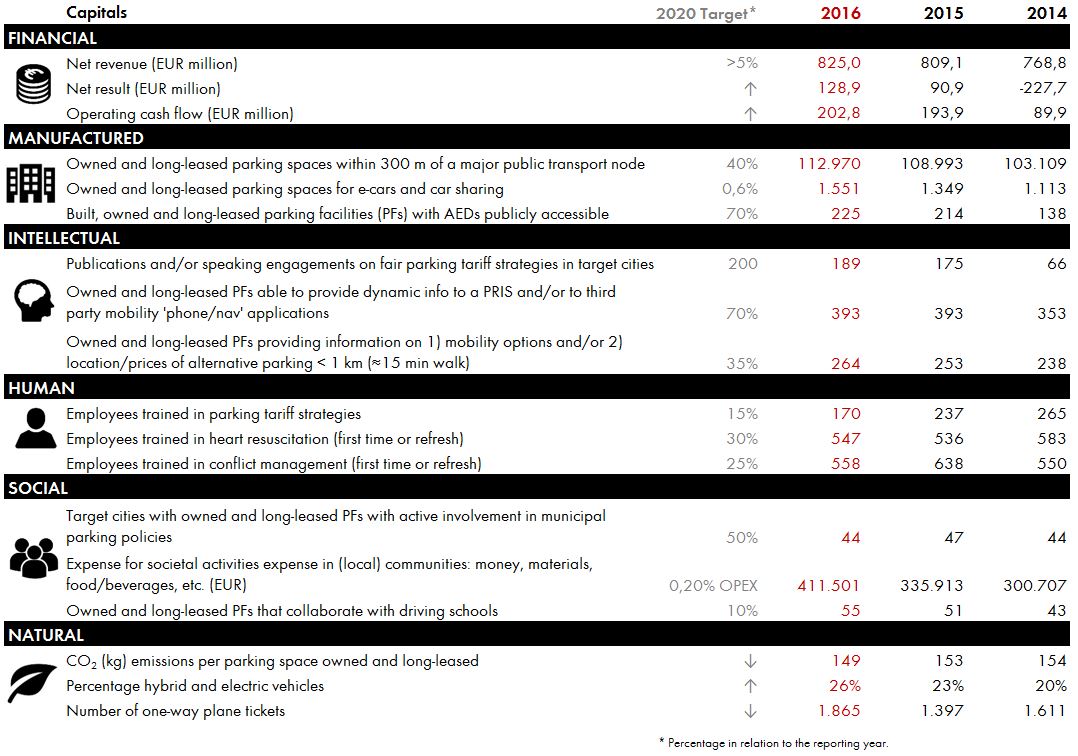

Key performance indicators

We want to create sustainable value for our stakeholders and society and we do this with our core activities. Our parking facilities are a stable investment and our parking services provide a stable cash flow.

Parking facilities have a positive impact on the quality of life of large cities. After all, a city is more attractive if there are fewer cars on the streets. With our parking facilities and services, we contribute to the accessibility of vital functions, such as hospitals, airports, universities and city centres.

Reducing traffic cruising for a place to park saves time and has a positive impact on air quality in the city. With this, we have an indirect influence on the well-being of people.

We also endeavour to take specific measures to reduce the negative impact that our own operating activities have on the environment. Our car fleet is slowly changing as we replace petrol and diesel cars with hybrid and electric cars.

In the following chapters we report on our 2016 financial and non-financial performance based on the Six Capitals as set out in the IIRC framework and our integrated management framework arising from our four-year plan, from 2017 to 2020.